PROSPECTUS > The Trend

More than 36 central banks of the world are in process of creating and deploying cryptocurrencies or CBDC (Central Bank Digital Currencies) in addition to their traditional Fiat currencies. The latter has been the basic element of world economies for more than a hundred years.

Countries are being turned from Fiat-centric financial and economic ecosystems to tri-polars of Fiat currencies, CBDCs, and Crypto tokens. Cashless or “cashless” societies, crypto assets, integrated digital and commercial banking, and financing will become part of our daily lives. The continuous integration and transformation of the above is an inevitable route, and will not irreversible. The growth in market size, investment, and return is groundbreaking as illustrated in the latter part of this prospectus.

CAM (Civic Asset Management Pvt Ltd) is founded to capture this defining financial and investment opportunity of a century. Its mutual fund is created and empowered with experts to pick and invest in digital assets and tokens on behalf of investors.

The objective of this fund is to provide coverage to our clients and investors in the emerging sectors of asset classes, cryptocurrencies, and digital tokens, thus an investment portfolio beyond the traditional methods ran by existing mutual fund management companies around the world. Our Crypto Mutual fund or ETF will run on the Decentralized Financial (DeFi) blockchain technology.

PROS | CONS |

There is no intermediary between transections thus lessens the transaction costs | If the passphrases are misplaced, the asset is lost and there is no governing body to help recover the lost assets. |

Offer more accessibility for loans and insurance without a credit score | Lack of consumer protections |

Offers Higher Interest Rates | High volatility and risks |

We also provide swap gains of crypto assets on the Defi Ecosystem. Liquid Swap is a liquidity pool developed based on the AMM (Automatic Market Maker) Principle. It consists of different liquidity pools, and each liquidity pool contains two digital tokens and assets. In providing the liquidity and the exchange rate of the paired tokens, the managers can gain high-interest rates on the liquidity provided. In most cases, the interest or the gains rate is 50%, while in some cases 171%.

Any easy method to gain passive income in the Defi ecosystem is by staking upon crypto assets. When staking, none of the assets will be lost or put at risk. The fund managers can stake or unstake depending on the percentage (%) gain. If the gain goes down a certain threshold, the assets will be unstaked, and then re-staked on another blockchain network that provides a higher yield percentage. In staking, the least number of days the asset is blocked tends to yield higher returns.

Live Example:Currently, CTK (Certik Token) provides the following APY

Duration in days

10 | 30 | 60 | 90 |

43.8% | 21.85% | 26.29% | 27.32% |

NFT or also known as Non-Fungible Token is a one-of-a-kind digital token that is permanently linked to a piece and is encrypted with the artist’s signature. These NFT’s could not be replaced, and they are validated and stored using blockchain technology. It validates the token’s ownership and authenticity. It is a form of digital asset that can be used to represent real-world artifacts like digital artwork, music, video, and in-game tradeable goods and memorabilia.

The Metaverse is a concept of a persistent online 3D universe that combines multiple different virtual spaces. This is the future of the internet, currently being depicted as WEB3.0. The metaverse allows its users to work, meet, socialize, and own real estate in these 3D spaces. The medium of exchange on the metaverse is cryptocurrencies. The token associated with these metaverses is traded on the blockchain of the DeFi Ecosystem.

Our Crypto Mutual Fund platform is created for global investors to be able to bridge the fiat currency to the crypto assets and to ascertain a higher APY.

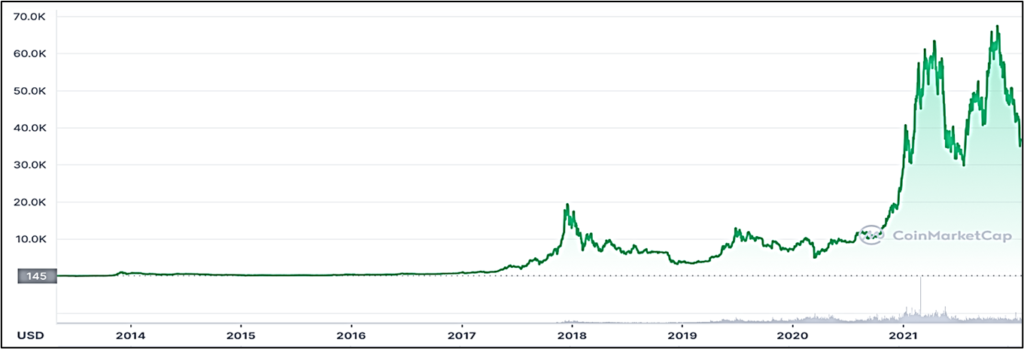

To this date, the cryptocurrency market is now worth more than the US $3 trillion. In little more than a decade, the market for digital assets has already quadrupled since its 2020 all-time high, being a result of investors being more comfortable with established tokens such as Bitcoin and blockchain networks such as Ethereum, Binance, and Solana. It is also greatly appreciated due to the upgrade and added new functionality of these blockchain networks.

This is also emphasized by the excitement of the possibilities of decentralized finance and community-driven utilities and the ability to create non-fungible tokens. Such growth is seen by the rise of meme coins like Dogecoin and Shiba Inu, which till today draws continuous attention. Shiba Inu was able to increase its price value by 1450 times in October 2021 from its inception in 2019.

At the end of the year 2021, the market cap of Cryptocurrencies of Bitcoin was traded at an all-time high of USD $46,306.45 with a 24-hour trading volume of USD $36.97B, while Ethereum attain USD $3,628.53 with a 24-hour trading volume of USD $15.72B. When compared to the year 2020, both these cryptocurrencies had an increase in price, an upward of 59.67% for Bitcoin and 396.02% for Ethereum. Ethereum is currently, the second largest cryptocurrency traded with a market cap of US $295B since its launch in 2015. In just 6 years it has been able to compete considerably with legacy banks such as JP Morgan with a market cap of US $970B which had more than 40years to attain this market cap.

Figure 1 Bitcoin Pricing over the years

Figure 2: Ethereum Pricing over the years